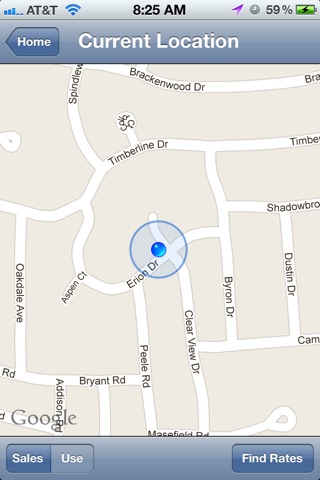

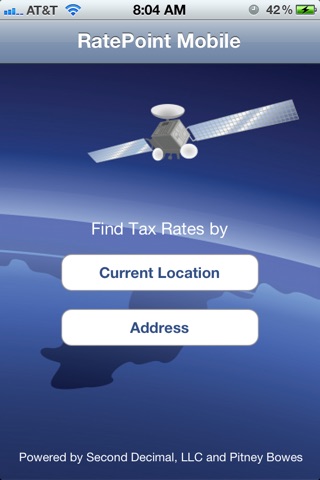

Ryan, LLC and Pitney Bowes have partnered to bring you RatePoint™ Mobile – a robust sales and use tax mobile rate lookup engine. The solution enables customers to find the sales/use tax jurisdiction and rate for any address or latitude/longitude coordinate. Users have two options: (i) use their current location (determined by their GPS coordinates), or (ii) enter a street address into the interface. Both methods will return the state, county, city, and special sales/use tax rates with additional information about effective dates etc.

The application helps companies who continue to experience challenges with accurate tax rate assignments that can lead to audit exposure and penalties for incorrect filings. Common problems include: understaffed and under-funded tax departments, out-dated or zip code-based tax software products and the need to research thousands of state and local taxing jurisdictions to keep up with the constantly changing rates and jurisdiction boundaries. To compound the problem, the zip code data most companies have is usually insufficient to accurately determine tax rates. RatePoint™ Mobile, however, can use a standard postal address and zip – without any other data – by converting it to a lat/long coordinate and using the results to ascertain the tax jurisdiction and rate.

This free application represents a subset of the functionality available in the commercial offering and is limited to 25 lookups per day.